Discover Solar Financing

Cash

Paying cash allows you to avoid a solar payment and say goodbye to rising electric rates for all of the electricity your solar produces for life.

-Quick return on investment

-Tax credits and rebates

-No solar payment after

Solar Loan

Sun Solar has a variety of loan options, or you can buy your solar system outright through a loan from a trusted bank or credit union.

-No Down Payment Options

-Loan payment is typically less

-Free electricity once paid off

Power Purchase

We install solar and instead of buying the system, you agree to buy the electricity it produces at a fixed or predictable price for 25 years.

-Predictable pricing

-Little to no upfront cost

-Zero maintenance responsibility

Get pre-qualified!

At Sun Solar, we offer a variety of residential solar panel installation options to suit your specific energy needs.

Commercial Options

Commercial Solar Loan

Sun Solar has a variety of loan options, or you can buy your solar system outright through a loan from a trusted bank or credit union.

-No down payment options

-Loan payment is less than electric bill

-Save money even if you can’t buy

Commercial Tax Credit

+ Depreciation*

Businesses can reduce the cost of installing solar energy systems by 30% through the federal solar tax credit.

-Used as a Tax Liability

-Claimed all at once or over 20 years

-Available to Government Agencies and Businesses

Cash for Commercial

Paying cash allows you to avoid a solar payment and say goodbye to rising electric rates for all of the electricity your solar produces for life.

-Quick return on investment

-Tax credits and rebates lower price

-No solar payment after

Commercial Reap grants

REAP grants offer rural businesses and agricultural producers up to 25% of project costs for installing renewable energy systems, making solar adoption more affordable and sustainable.

-For Rural-Small Businesses or Agriculture

-Loan Guarantee

-Cover 25% of Your System

Commercial DEPRECIATION*

Businesses that invest in solar energy systems can benefit from accelerated depreciation, allowing them to deduct a significant portion of the system’s cost over a shorter period.

-New Tax Law

-Claim all at once or over 5 years

-Depreciate 100% of your system after the first year

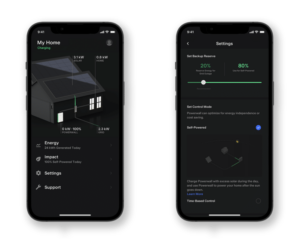

Now Partnered with SunSure

The SunSure Warranty Solutions product provides warranty coverage for your solar products. SunSure works directly with your contractor to reimburse for claims submitted.

25-Year Workmanship Warranty

Sun Solar offers a comprehensive workmanship warranty so that you as the customer have 110% peace of mind that if there’s a hiccup in the road, Sun Solar has the solution.

30-Year Battery Warranty

Available exclusively through Solar Insure’s Certified Providers, the 20-Year Warranty is an optional add-on in conjunction with the 30-Year Warranty.